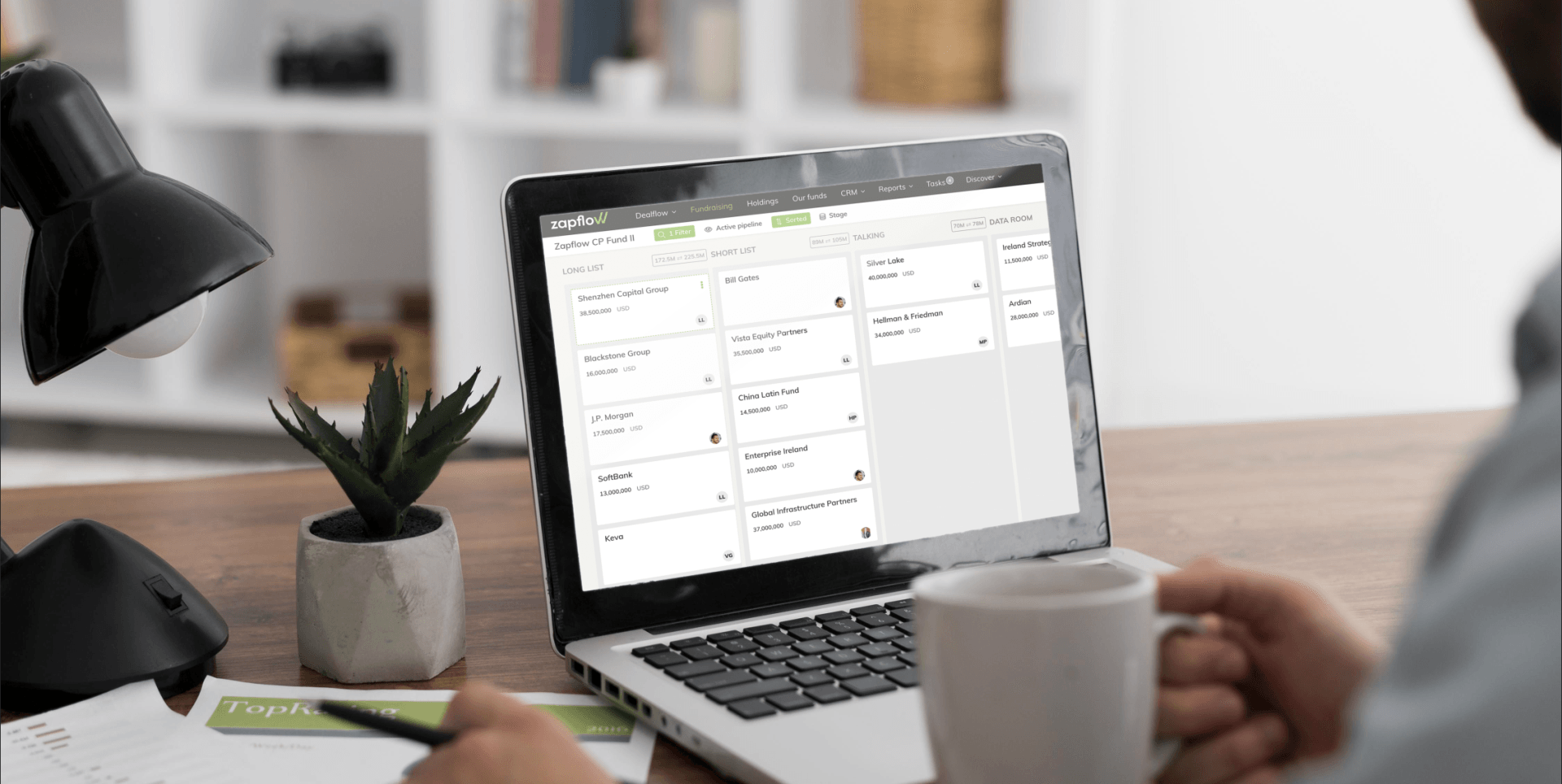

New Product Release

Zapflow Explorer enables you to quickly find similar companies with AI driven search capabilities

At Zapflow, we aim to discover the most effective way to help our customer improve their productivity. With this in mind, we have launched Zapflow Explorer in a partnership with Ocean.io - a leading account-based marketing platform. Zapflow users can now search over 420 million companies globally to deliver data in a matter of seconds, not days.

January 1st, 2020 - 5 min read

Exclusive articles

🔒 Exclusive content

2021, the rise of AI in the investment industry

As AI and machine learning continue to play a more prominent role in identifying and managing investment.

🔒 Exclusive content

2021 yearly market predictions

2021 arrives with Covid-19 vaccines, a Brexit deal, and (tentative) hope of a buoyant new year.

🔒 Exclusive content

UK pharmaceutical stocks

are rising

Unsurprisingly, the pharmaceutical industry has turned out a strong performance through the global pandemic.

🔒 Exclusive content

The brief Brexit rally

The long-anticipated Brexit withdrawal trade agreement is finally here.

🔒 Exclusive content

How AI is changing the investment space

Today’s advances in the technological sphere are paving the way towards an environment where IoT (internet of things) and artificial...

🔒 Exclusive content

Pitfalls and prosperity in the post-pandemic world

The Covid-19 pandemic shocked the world. The illusion of a resilient, modern world was shown up.

Commonly read articles

Hear more from Zapflow

Sign up for our FREE newsletter & be first to know about our latest features, industry news, events and updates on increasing work-efficiency!